Jakarta, Indonesia Sentinel — Indonesia’s sovereign wealth management body, Daya Anagata Nusantara (Danantara), is exploring a potential partnership with global investment giant BlackRock as part of its broader effort to attract foreign capital and support sustainable development.

Danantara CEO Rosan Roeslani shared news of the initiative during his working visit to New York on Tuesday, May 13, 2025, posting photos from his meeting at BlackRock headquarters on his personal Instagram account.

“This partnership reflects the synergy between Indonesia’s development priorities and BlackRock’s global leadership in asset management, energy transition financing, and digital infrastructure,” Rosan wrote.

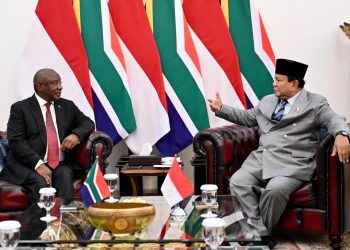

During the visit, Rosan met with BlackRock Senior Managing Directors Bayo Ogunlesi, Raj Rao, and Charles Hatami. He introduced Danantara as a professional sovereign asset manager ready to collaborate with international investors, including BlackRock.

BlackRock, which manages over $11 trillion in assets, is considered the largest investment management firm in the world. According to Rosan, the company views Indonesia as a country with a strong and resilient economy.

“BlackRock’s interest demonstrates continued global investor confidence in Indonesia’s economic outlook and opens the door for greater foreign direct investment,” Rosan stated.

Read Also:

José Mujica, the World’s ‘Poorest’ President Passed Away at 89

In addition to BlackRock, Danantara also held a meeting with the U.S. International Development Finance Corporation (DFC) during the visit. According to Antara, both parties expressed a commitment to advancing sustainable development initiatives.

The meeting, held at the Indonesian Embassy in Washington, D.C., brought together Rosan and DFC’s Chief of Staff and Head of Investments, Conor Coleman, to discuss sustainable financing opportunities for Indonesia’s priority projects, particularly in the energy transition and digital transformation sectors.

Danantara reaffirmed its commitment to strengthening an investment ecosystem that supports Indonesia’s shift toward a greener and more digital economy.

The discussions were described as constructive, with DFC responding positively to Indonesia’s investment proposals. The agency sees Indonesia as a strategic partner in advancing impact-driven and sustainable finance.

“We see tremendous potential in Indonesia’s green and digital economy. A strong partnership will pave the way for innovative financing models that directly support sustainable development,” Coleman said.

(Raidi/Agung)