Jakarta, Indonesia Sentinel — The Indonesian government will introduce two new tax surcharges on motor vehicles beginning January 5, 2025. The new tax surcharges, or “opsen,” include a surcharge on the Motor Vehicle Tax (PKB) and the Motor Vehicle Title Transfer Fee (BBNKB).

These measures are mandated under Law No. 1 of 2022 on Financial Relations between the Central Government and Regional Governments. Under the law, surcharges (opsen) refers to an additional tax calculated as a specific percentage.

The surcharges on Motor Vehicle Tax (PKB) is an extra charge imposed by municipal or district governments on the principal PKB amount, in accordance with existing regulations. Similarly, the surcharges on Motor Vehicle Title Transfer Fees (BBNKB) is an additional levy imposed by municipal or district governments on the principal BBNKB amount.

According to Detik, the surcharges will be collected by local city and regency governments as a percentage of the primary PKB and BBNKB amounts. Specifically, the surcharge rates for both PKB and BBNKB have been set at 66% of the principal tax owed.

Increased Tax for Motor Vehicle Owners

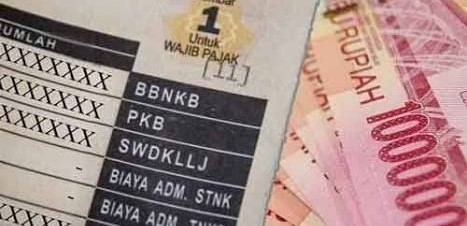

Under the new structure, there will be an increase to the total tax burden for motor vehicle owners. Currently, motor vehicle owners are subject to seven tax components, including PKB, BBNKB, and administrative fees. With the new PKB and BBNKB surcharges, the total number of tax components will rise to nine.

The surcharge rates for both PKB and BBNKB have been set at 66% of the principal tax owed. For example, if the annual Motor Vehicle Tax (PKB) on a vehicle is Rp1 million, the additional surcharge would amount to Rp660,000 (66% of the principal PKB). This brings the total tax payment to Rp1.66 million.

14-Year-Old Kills Father and Grandmother in Stabbing Incident, Claims Have Heard ‘Whispers’

The surcharges will be paid concurrently with the existing PKB and BBNKB obligations. Tax payment records, typically printed on the back of a vehicles registration certificate (STNK), will include two new columns to reflect the surcharge amounts.

Payment and Revenue Distribution

The new surcharges will follow the same payment and distribution mechanisms as the current taxes. Banks will split tax payments into several accounts, ensuring the funds are appropriately allocated to regional and national government entities:

- PKB and BBNKB payments will be deposited into provincial Regional General Treasury Accounts (RKUD).

- Administrative fees for registration certificates (STNK) and license plates (TNKB) will go to the State Treasury (RKUN).

- Compulsory insurance contributions (SWDKLLJ) will be transferred to Jasa Raharja, the state insurance provider.

- PKB and BBNKB surcharges will be directed to the RKUD of the city or regency where the vehicle is registered.

The introduction of these additional motor vehicle tax underscores the government’s effort to strengthen regional revenue streams while signaling potential adjustments for vehicle owners. As the new policy takes effect in January 2025, its implementation and impact on the public will be closely observed.

(Raidi/Agung)