Jakarta, Indonesia Sentinel — In 2025, Indonesia is rolling out an exciting new initiative to encourage car purchases, with a significant Indonesia Vehicle Tax Discount aimed at making vehicles more affordable for consumers. This move is part of the government’s broader strategy to stimulate the economy while promoting environmentally-friendly vehicles. The discount targets various segments of the automotive market, from electric vehicles (EVs) to older cars, and it is expected to have far-reaching effects on both consumers and manufacturers.

Objectives of the Indonesia Vehicle Tax Discount Program

Indonesia’s vehicle tax discount is designed to achieve several key goals:

- Encouraging Green Vehicle Adoption: With a focus on electric and hybrid vehicles, the program is part of Indonesia’s efforts to reduce carbon emissions and pollution. By offering tax relief, the government aims to make EVs more attractive to consumers and accelerate the shift toward greener transportation options.

- Supporting the Local Automotive Industry: The discount program is also aimed at boosting sales in Indonesia’s automotive sector, which has been a crucial contributor to the country’s economy. The move is expected to drive consumer interest and increase sales of both domestic and imported vehicles.

- Relieving Financial Pressure on Consumers: By lowering the cost of vehicles through tax discounts, the government is making it easier for Indonesians to purchase new cars, which can have a direct impact on middle-class consumers who are struggling with rising costs of living.

Key Features of the 2025 Indonesia Vehicle Tax Discount

The Indonesian government has outlined several aspects of the tax discount program for 2025, which will be available to both first-time car buyers and existing car owners looking to replace their vehicles. Here are the key details:

- Discount on Electric and Hybrid Vehicles: Indonesia is offering a significant tax discount for electric and hybrid cars, as part of the government’s green initiative. These vehicles will be eligible for a 100% discount on the luxury goods tax (LGT) for the first half of 2025. Starting in July 2025, this discount will be reduced to 50%, but it still represents a considerable financial incentive for those interested in purchasing an electric or hybrid car.

- Discounts for Older Vehicles: The program also extends to vehicles that are over 10 years old. Owners of these cars will be eligible for up to a 50% discount on vehicle taxes, encouraging car owners to replace their aging vehicles with newer, more environmentally-friendly options. This initiative is designed to reduce emissions from older, less efficient cars.

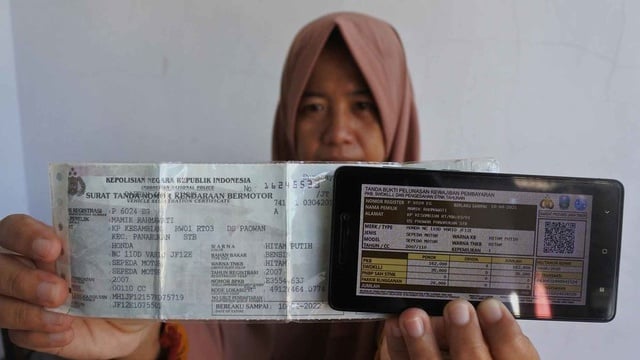

- Tax Relief for Vehicles with Valid Registration: To qualify for the discount, vehicles must have valid registration (STNK and BPKB). This condition ensures that the discount is granted to properly maintained and legally registered vehicles, encouraging more people to adhere to tax obligations and vehicle regulations.

Government Confirms 12% VAT Exempt Essential Goods and Services in Indonesia, Here’s the List

Implications for Car Buyers in Indonesia

For consumers in Indonesia, the 2025 vehicle tax discount represents an opportunity to save significantly on new car purchases. Those looking to buy electric or hybrid vehicles will benefit the most, as the 100% tax reduction for these models provides an unmatched incentive to make the switch to more sustainable options.

However, potential buyers should be aware of the program’s eligibility criteria and the specific tax relief for different vehicle types. This will help them make informed decisions and avoid missing out on the discounts.

Impact on Indonesia’s Automotive Industry

The 2025 vehicle tax discount is expected to have a positive impact on Indonesia’s automotive sector, particularly for manufacturers of electric and hybrid vehicles. As the government pushes for greener transportation, automakers will likely ramp up efforts to develop and market EVs, aligning with the demand generated by these incentives.

In addition to benefiting domestic manufacturers, the program will also encourage international automakers to expand their presence in Indonesia. This is a critical development, as foreign car brands increasingly recognize the growing market potential in Southeast Asia.

A Move Toward Sustainability

The vehicle tax discount is just one part of Indonesia’s broader efforts to embrace environmental sustainability. The program aligns with global trends of shifting toward electric vehicles, and it reflects Indonesia’s commitment to achieving its climate goals. By incentivizing consumers to choose electric and hybrid vehicles, the government is making strides in reducing the country’s carbon footprint and promoting long-term environmental benefits.

Conclusion

Indonesia’s 2025 vehicle tax discount is a significant move aimed at stimulating the automotive market and encouraging consumers to choose environmentally-friendly vehicles. For both consumers and car manufacturers, this program represents a win-win scenario. Consumers stand to save a considerable amount on new cars, particularly electric and hybrid models, while manufacturers benefit from an expanded market driven by tax incentives.

For American readers looking to understand how Indonesia is navigating its green transition and boosting its local economy, this vehicle tax discount serves as an excellent example of government intervention in driving both consumer behavior and industrial growth. As more countries around the world explore similar strategies, Indonesia’s 2025 vehicle tax discount provides a glimpse into the future of automotive sales and sustainability.

(Becky)